What is HS code (Harmonized System Code)?

The Harmonized System (HS) code is a categorization system created, developed, and maintained by the World Customs Organization (WCO). Every commodity is tagged to an HS code, and the code assigned to it is internationally recognized in almost every country and is commonly used in customs to clear shipments.

How to set HS Code at DelyvaNow Customer Portal?

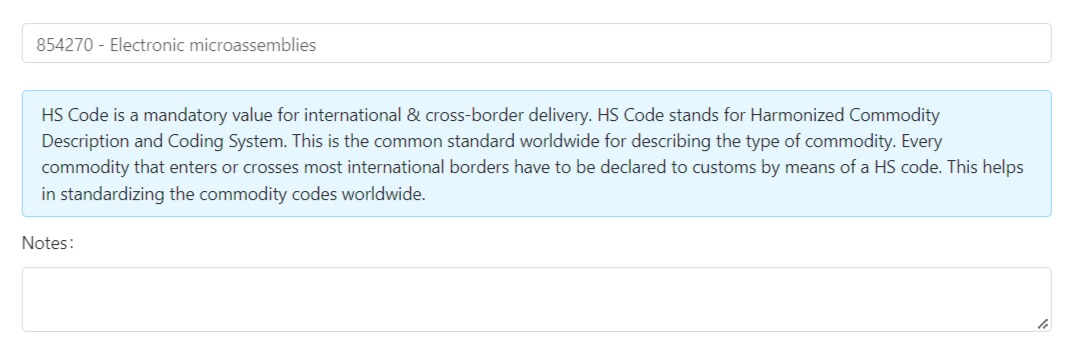

While placing an order with DelyvaNow Customer portal, all you need to do is fill in the item type on HS Code form, and our system will automatically populate the HS Code for you.

So you do not need to engage with a customs broker in order to determine the correct HS Code for your item.

What happens if I use the incorrect HS code?

Tariff classifications can be open to interpretation, which can result in a shipment being misclassified. Regardless of the reason, misclassified shipments can have multiple adverse consequences including:

- Overpayment/Underpayment of duties

- Failure to utilize free trade agreements or used in error

- Lead fines, liquidation and other penalties

- Unexpected customs clearance delays

- Seizure of the products

- Denial of import/export privileges

What is the purpose of HS code in import and export?

HS codes are used to classify and define goods traded internationally to determine rate of duty, eligibility for exemptions, qualification for approved manufacturer/assembler tariff provisions and calculation of any other additional taxes (e.g. excise).

If you have any questions or concerns, please don’t hesitate to contact us via Live Chat from 8 AM – 10 PM (GMT +8).